How to automate your saving habits to make your life easier

This article explores how automation can simplify personal finance by optimizing saving habits. It highlights the benefits of consistent, convenient, and stress-free savings through tools like automatic transfers, budgeting apps, and employer programs. By integrating automation, individuals can effortlessly work towards their financial goals while reducing anxiety.

Simple Strategies to Save Money Every Month

This article offers practical strategies for saving money each month, emphasizing budgeting, automatic savings, mindful spending, and meal planning. By implementing small changes in spending habits, individuals can build financial stability and achieve their monetary goals, all while enjoying a more secure future.

How to Save Money in Daily Life Without Radically Changing Your Lifestyle

This article offers practical strategies for saving money without making drastic lifestyle changes. By tracking spending, cooking at home, using discounts, limiting subscriptions, and evaluating utility usage and transportation costs, readers can achieve significant savings while maintaining their daily pleasures and working toward financial goals.

How to Handle Collections and Maintain Your Financial Health

Navigating collections can be challenging, but understanding your financial landscape is essential. Effective strategies include staying informed about consumer rights, maintaining open communication with creditors, and developing a realistic budget. Building an emergency fund and seeking professional help when needed can further enhance your financial stability and health.

The impact of your credit score and how to gradually improve it

Understanding your credit score is vital for financial success, affecting loan approvals and interest rates. By focusing on timely payments, maintaining low credit utilization, and monitoring your credit report, you can gradually improve your score. Consistent, proactive steps lead to increased opportunities and better financial stability.

Step-by-step to create a family budget with variable income

This guide offers step-by-step strategies for creating a family budget amid variable income. It emphasizes assessing income sources, tracking expenses, establishing flexible spending categories, and maintaining an emergency fund. Regular monitoring and adaptability to income fluctuations empower families to achieve financial stability and confidently manage their finances.

How to Use Apps to Monitor and Reduce Your Debt

Managing debt can be simplified with specialized apps that track balances, set budgets, and offer personalized repayment plans. By leveraging these tools, users can monitor their progress, receive payment reminders, and access educational resources, all while making informed financial decisions to achieve their debt-free goals.

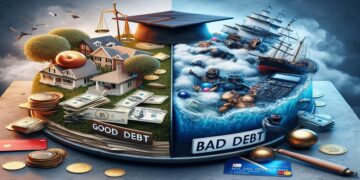

Difference between good debt and bad debt: learn how to identify

Understanding the difference between good and bad debt is essential for effective financial management. Good debt, like mortgages and student loans, can enhance your financial future, while bad debt, such as high-interest credit cards, can lead to financial strain. Learning to distinguish these debts empowers better financial decisions.

Strategies to Rebuild Your Credit After Debt

Rebuilding credit after debt is attainable with dedication and effective strategies. Understanding credit fundamentals is crucial, followed by establishing responsible financial habits. Tools like secured credit cards and credit builder loans can aid in recovery. Consistent monitoring and patience will ultimately lead to improved financial health and opportunities.

How to control your consumption impulses and maintain healthy credit

Discover practical strategies to control consumption impulses and enhance financial health. Learn to recognize personal spending triggers, implement budgeting techniques, and utilize tools like the 24-hour rule. By fostering mindful spending habits, you can protect your credit and move closer to achieving long-term financial goals.