The impact of debts on mental health and how to seek balance.

The Impact of Financial Burdens on Mental Well-Being

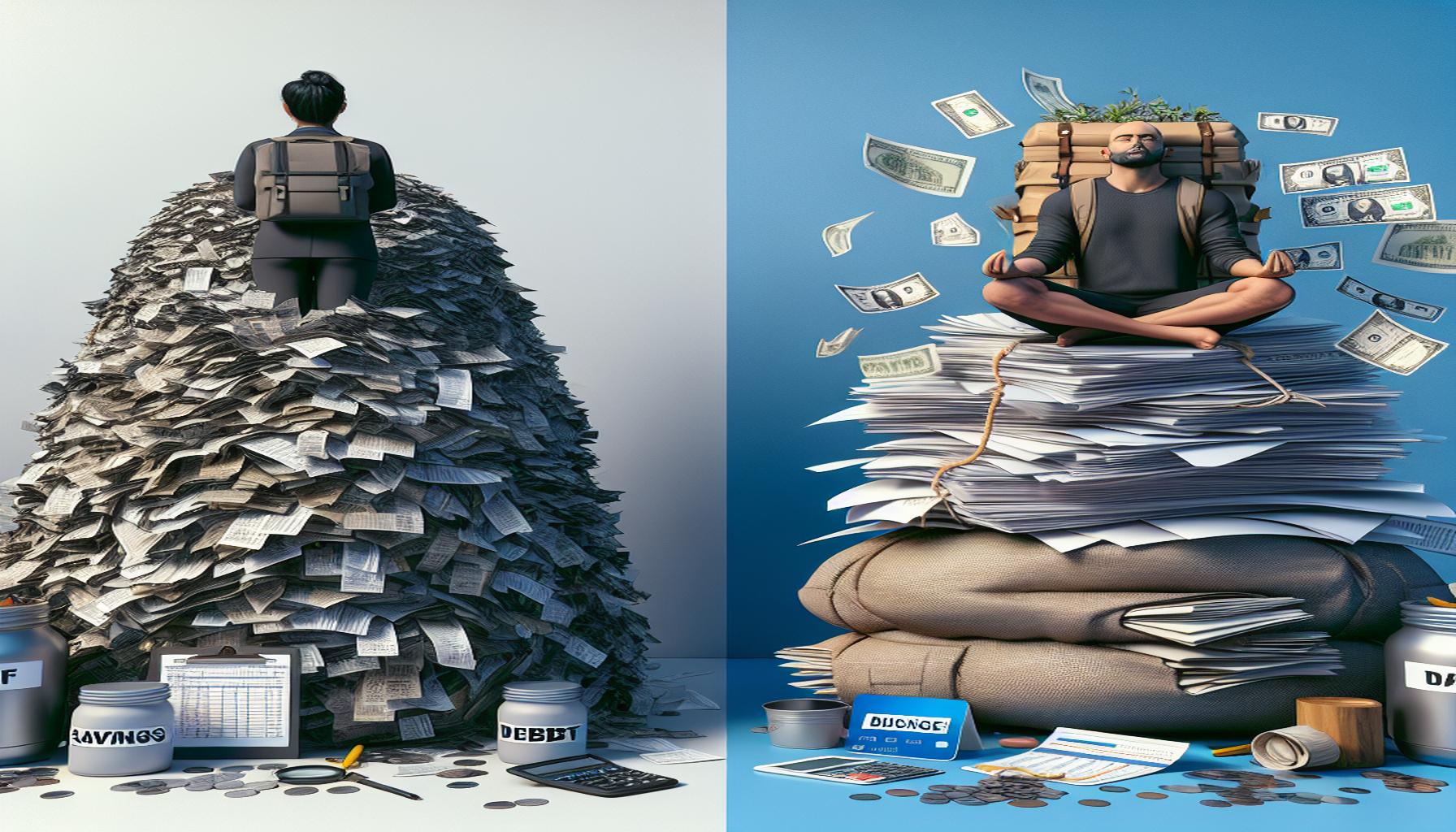

Carrying debt can feel like carrying a heavy weight on your shoulders. It often leads to a host of emotional issues that can deeply affect one’s mental well-being. The implications of financial burdens extend far beyond just the numbers on a balance sheet. Understanding this connection is essential for anyone facing financial struggles.

One significant aspect of debt is its ability to cause increased stress levels. When individuals are overwhelmed by unpaid bills, mounting interest rates, and the fear of losing financial stability, it disrupts their daily life. Everyday activities, such as working, engaging with family, or pursuing hobbies, can become overshadowed by financial worry. For instance, someone may find it challenging to focus at work or engage in conversations with family members due to preoccupations about their financial situation.

Moreover, many individuals may experience feelings of hopelessness regarding their financial future. This pervasive sense of despair can create a loop of negative thoughts, making it difficult to see a path forward. For example, a person struggling with credit card debt might feel they are in a never-ending cycle, leading to procrastination in addressing the issue, which only exacerbates the feeling of hopelessness.

Another common reaction to debt is anxiety, which can often lead to increased social withdrawal. People may feel embarrassed about their financial struggles and, therefore, avoid social interactions. Affected individuals might decline invitations to gatherings or outings out of fear of not being able to spend freely or the anxiety of discussing their situation with others. This self-isolation can perpetuate feelings of loneliness and depression.

In addition to emotional turmoil, the consequences of debt can manifest physically as well. Symptoms such as fatigue, headaches, or sleep disturbances can emerge, making it even harder to deal with daily responsibilities. This physical strain can further hinder one’s ability to find effective solutions to their financial problems.

It’s essential to acknowledge these various mental health impacts associated with debt as the first step toward regaining control. Taking proactive steps can significantly improve both financial and mental health. Some effective strategies include:

- Seeking professional financial advice to develop a manageable repayment plan tailored to individual circumstances. This can provide a clearer path forward and lessen the uncertainty that contributes to stress.

- Engaging in self-care activities to combat stress, such as regular exercise, meditation, or pursuing hobbies that spark joy and relaxation. These practices can support mental resilience.

- Connecting with support groups or counseling services to share experiences, gain insights, and find encouragement from those in similar situations. These connections can help combat isolation and foster a sense of community.

By recognizing the profound link between debt and mental health, individuals can make informed choices that prioritize both their financial well-being and emotional health. Striving for this balance is crucial in embarking on a journey toward improved mental clarity and financial stability.

SEE ALSO: Click here to read another article

Understanding the Emotional Burden of Debt

When individuals find themselves in a cycle of debt, they may not fully realize the emotional toll it is taking on their mental health. Feeling trapped by financial obligations can lead to a range of negative emotions, including chronic stress, anxiety, and even depression. These emotional states can be debilitating, making it essential to address both the financial and psychological aspects of debt.

Chronic stress is one of the most evident effects of debt. The pressure of mounting bills can feel suffocating, causing individuals to constantly worry about their financial situation. For instance, consider someone who carries medical debt; they may find it difficult to enjoy time with family or engage in activities that once brought them joy, as their mind is preoccupied with thoughts of how to cover their expenses. This perpetual state of worry can lead to exhaustion and burnout.

Furthermore, the anxiety that comes from debt can create a vicious cycle. When facing financial challenges, individuals may find it difficult to concentrate at work, resulting in decreased productivity. This lack of focus can then lead to poor job performance, which could ultimately affect their income. Imagine a person who, overwhelmed by their credit card bills, struggles to meet deadlines. This can escalate their feelings of inadequacy, adding to their distress.

Another significant aspect to consider is how shame and embarrassment can influence mental health. Many people fear judgment from friends and family regarding their financial situation. As a result, they may withdraw from social commitments, opting to stay home instead of explaining or confronting their circumstances. This isolation can intensify feelings of loneliness, which may lead to depression. For instance, if someone regularly declines invitations to social events that involve spending, they may start feeling excluded, further exacerbating their mental struggles.

Recognizing the mental health impacts of debt is merely the first step. To navigate these challenges effectively, individuals can employ several strategies:

- Establish a budget to monitor income and expenses, helping to create a clearer picture of financial health. This process can provide a sense of control and direction.

- Set small, achievable financial goals. These milestones can help build confidence and momentum in tackling debt, making the process feel less daunting.

- Reach out to friends or family members for support. Sharing your financial worries can lighten the emotional load and provide encouragement. Sometimes, just having someone to talk to can make a world of difference.

Incorporating these strategies can help individuals regain a sense of balance and control over their financial situation. By acknowledging the emotional weight of debt and addressing it through constructive actions, one can work towards fostering a healthier mindset and ultimately achieving financial stability.

CHECK OUT: Click here to explore more

Practical Steps to Mitigate the Mental Health Effects of Debt

Understanding the emotional toll that debt can take is crucial, but equally important is knowing how to actively manage and alleviate these pressures. Implementing practical steps can lead to a healthier mindset and support overall financial wellness.

One effective method to counter the stress of debt is to practice mindfulness and stress reduction techniques. This can involve simple practices like meditation, yoga, or even regular physical exercise. For example, taking time each day to meditate or perform deep-breathing exercises can create a space of calm, helping to alleviate anxiety and improve focus. Studies have shown that mindfulness can have a profound effect not only on mental health but also on decision-making abilities, which are essential when managing finances.

Another fundamental aspect is education. Many individuals manage their debts without adequate financial knowledge, leading to missteps. Seeking financial education through workshops, online courses, or community programs can empower individuals with the information they need to make informed decisions. For instance, learning about effective debt management strategies such as the “snowball method,” where one focuses on paying off smaller debts first to gain momentum, can lead to more positive feelings and motivation.

In some cases, reaching out for professional help may be necessary. This could involve speaking with a financial advisor or a credit counselor, who can provide personalized strategies and support. Organizations such as the National Foundation for Credit Counseling (NFCC) offer resources and guidance tailored to individual situations. Working with a professional can help clarify paths to debt repayment, offering a manageable plan that can lessen feelings of being overwhelmed.

It’s also important to recognize the value of positive self-talk while navigating debt. Practicing self-compassion can help mitigate feelings of shame and inadequacy. For example, instead of chastising oneself for accruing debt, it might be more beneficial to acknowledge past mistakes while focusing on a commitment to improvement. This shift in mindset can be transformative; instead of viewing debt as a personal failing, it can be seen as a challenge that can be overcome with time and effort.

Moreover, maintaining a balanced lifestyle is vital. Engaging in activities that promote joy and relaxation, such as spending time with friends or pursuing hobbies, can provide a necessary respite from financial concerns. For instance, volunteering at a local charity can not only distract from financial stress but also foster a sense of community and purpose, positively impacting one’s mental outlook.

Lastly, consider establishing a support network. Whether it’s family, friends, or a support group, sharing your burdens can lighten the load. This support system can offer encouragement and accountability, which can be incredibly helpful during hard times. For instance, finding a close friend who understands your situation might make it easier to discuss financial struggles openly and seek advice.

By embracing these practical strategies, individuals can work towards not only managing their debts but also enhancing their overall mental well-being. Both financial and emotional health are intertwined, and by nurturing both areas, a more balanced and fulfilling life can be achieved.

CHECK OUT: Click here to explore more

Conclusion

In conclusion, the intricate relationship between debt and mental health is undeniable. Individuals grappling with financial burdens often experience significant emotional strain, manifesting as anxiety, depression, and feelings of isolation. However, it is crucial to remember that there are effective strategies to counter these challenges and restore balance to one’s life.

By incorporating mindfulness techniques, seeking financial education, and reaching out for professional help, individuals can take proactive steps towards regaining control over their financial situations. Establishing a support network and practicing positive self-talk can further lighten the emotional weight of debt. Recognizing that debt does not define one’s self-worth is a vital perspective necessary for healing and growth.

Moreover, maintaining a well-rounded lifestyle through hobbies, social interactions, and community involvement can provide necessary breaks from financial stress and foster a healthier mental state. It is essential to see debt management not merely as a financial task but as a comprehensive approach to well-being that embraces both mental and emotional health.

Ultimately, understanding the downward spiral of debt-related stress is the first step toward recovery. With determination, education, and support, individuals can create a path toward financial freedom and a fulfilling life. Encouragingly, many have traveled this road successfully. You too can find balance and peace, transforming your relationship with debt into a manageable challenge rather than an insurmountable burden.

Related posts:

Step-by-step to create a family budget with variable income

How to turn the economy into a lifestyle and not a sacrifice

How to avoid falling back into the debt cycle after paying it off

How to prioritize debts in times of reduced income

Strategies to Save Money While Living Alone Without Sacrificing Comfort

Simple Strategies to Save Money Every Month

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.